Learn more about Financial Accounting and Management notes from BCA solved question papers. For a prosperous corporate career, develop your accounting abilities and get insightful knowledge of financial management ideas.

Dudes 🤔.. You want more useful details regarding this subject. Please keep in mind this as well. Important Questions For Financial Accounting and Management: * Important Short Questions * Solved Question Paper * Syllabus

Section A: Financial Accounting and Management Very Short Question Answers

Q1. Describe the meaning of financial accounting.

Ans. Almost every business has an accounting system. It is a method of gathering, assessing, and reporting monetary information about a business.

Q2. What do you mean by double entry system of accounting?

Ans. Every commercial transaction has two parts: debit and credit. A double entry system is an accounting system in which both aspects of each transaction are recorded according to prescribed rules. It does not mean that every transaction is recorded twice, but that one aspect is recorded once and the other side is recorded twice, for example, 500 are received from Mohan. This is a business transaction. Cash is received in this transaction, and Mohan is the payer. Thus, it has two aspects: 1. Receiving of cash and 2. Payment by Mohan. One of these aspects is debited and the other is credited according to certain prescribed rules.

Q3. What is funds flow statements?

Ans. A fund flow statement is a method of assessing and interpreting a company’s financial statements. It is a technical gadget used to examine the changes in a business’s financial or working capital status between two dates.

Q4. Give a list of long-term source of finance.

Ans. Long-term Sources of Finance :

- 1. Debenture

- 2. Share

Q5. What are the current assets?

Ans. The various components of current assets are forecast as follows :

- (a) Inventories: Inventories can be forecasted using either turnover rates or precise plans of acquisition, production, and sales. The strategy chosen will be determined by the availability of the data. Though schedules can provide a more precise picture, the additional work and data necessary should be balanced against the benefits of further modifications. Finance managers frequently utilise turnover ratios to anticipate aggregate inventory levels. The inventory policies of the company can also be used to determine the projected levels.

- (b) Debtors: The finance manager can use the receivable turnover ratio or the norms of the existing credit policy to estimate the amount owing to the company by customers at the conclusion of the forecast period. Debtors can also be estimated using the debtors’ opening balance, predicted credit sales, and expected collections.

- (c) Cash: Management policy of the minimum cash level can be used as a guide to estimate this item. In case borrowings from the banks are fixed, this item can also be balancing of ‘plug in’ figure to equalise assets and liabilities.

- (d) Other Assets: Other assets like prepaid, goodwill, patents, etc. are usually projected assuming no change, unless there is specific information indicating a change in these assets.

Section B: Financial Accounting and Management Short Question Answers

Q6. Describe in shorts different accounting concept.

Ans. Accounting concepts/assumptions are the cornerstone of proper and methodical accounting. Every firm must accept these assumptions, often known as pillars of accounts.

1. Separate Entity Concept : This concept assumes that business is an entity distinct and separate from its owner. All business transaction we have to record from firm’s point of view and never the view of owner. As an accountant, we are concerned with the business not the businessman.

In accounts we record transaction in the books of shop, establishment, factory, firm company and never in the books of proprietor, partner and shareholders.

Legally, a sale proprietor or the partner of a partnership firm are not separate from their business unit but in accounting the business its are assumed to have distinct entity. Accounting entity is different from business entity.

2. Money Measurement Concept : In accounting, we identify and record only those transactions which are financíal in nature.

Accounting transactions must have their monetary value. The worth of the transaction must be measured in terms of money. In all he accounting records, we have amount column. There is never any accounting records in metres, litres, kilograms and quintals.

For example, statement that the business was stored with Rs 1,00,000 cash and 50,000 metres ot cloths is meaningless and fail to tell us the capital of business. If the value of 50,000 metres cloths is Rs 8,00,000 we can say that our business started with Rs 9,00,000 which will be meaningful.

3. Going Concern Concept: This concept describes how a business will exist indefinitely. Alternatively, we presume that the business will continue indefinitely. As a result, the company purchases fixed assets such as land and buildings, as well as plant and machinery.

We would not have purchased these assets if the concept of going concern had not been present.

4. Accounting Period Concept : The company’s lifespan is thought to be endless. This assumption would be unnecessary if the accountant could wait until the business was closed to produce the final accounts. However, the proprietor or owner, as well as other consumers of the business’s accounting information, cannot wait so long to study the company’s financial status and measure its income. Thus, an enterprise’s life is divided into tiny periods in order to measure its performance at regular intervals.

Proprietorship and partnership can choose their own accounting period but the difference between the choosing date of two final accounts should not exceed twelve months. This period may be calendar year 1st Jan to 31st Dec of the year and financial year 1st April to 31st March of the next year or even Diwali to Diwali but always restricted to one year, i.e. 12 months.

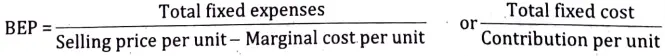

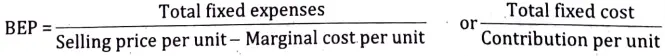

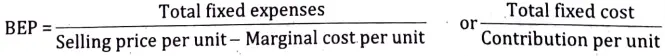

Q7. What is break even point? Illustrate with an example.

Ans. Break-Even Point (BEP) : When a company’s total revenues match its complete costs, it has reached the point of no profit and no loss. At this moment, the contribution equals the fixed cost. A company that achieves break-even point with fewer units of production will undoubtedly outperform another company that achieves break-even point with more units of production.

Q8. Describe explicit and implicit costs.

Ans. Explicit costs are those expenses which are actually paid by the firm (paid-out costs). These costs appear in the accounting records of the firm. On the other hand, implicit costs are theoretical costs in the sense that they go unrecognised by the accounting system. These costs may be defined as the earnings of those employed resources which belong to the owner himself. The examples of such costs are opportunity cost of the owner’s services, say as the manager of the firm, opportunity cost of land belonging to the owner of the firm and normal return equal to the market rate of interest on the owner’s own capital invested in the business. These implicit costs are not included by the accountant of the firm in its accounting statements. However these costs are considered relevant by economists while calculating the economic profits of the firm.

Section C: Financial Accounting and Management Detailed Question Answers

Q9. What is trial balance? What type of errors cannot be traced from a trial balance?

Ans. Trial balance is a statement, prepared with the debit and credit balances of ledger accounts to test the arithmetiçal accuracy of the books.

There are some errors in preparing the trial balance which does not affect the equality of debits and credits of the trial balance but violates its objective of checking the accuracy of the accounts. These are errors that remain undetected in spite of the agreement of a trial balance.

- (a) Errors of Principle: When the fundamental principles of accounting violated while preparing the accounts, this is known as error of principle. These errors are made when there is no proper distinction between capital and revenue items, i.e. capital expenditure and vice versa.

- (b) Compensating Errors: Compensating errors is when the effect of one error is neutralised by some others errors. For example, if Ram’s account is debited with Rs 500 instead of Rs 5000 and on the other hand Shyam’s account is debited with Rs 5000 instead of Rs 500. This situation would not have any effect on the trial balance.

- (c) Errors of Complete Omission: If a trånsaction is completely omitted or not recorded in the journal or any subsidiary books, it is termed as errors of omission, such error will not effect the trial balance as it is not recorded on the debit side of an account nor on the credit side of another account.

Q10. What do you mean by ‘financial’ statement? Discuss the importance of financial statements.

Ans. Financial analysis is a selection, relationship, and evolution process. Financial statements summarise a company’s financial situation and operations. Financial statements are an essential instrument for financial analysis. Various parties interested in them utilise this tool to make decisions.

Financial statements are prepared to forecast the profit and financial status. There are two financial statements: (i) income statement for the period under study, (ii) a balance sheet as at the end of the period.

Importance of Financial Statements :

Financial statement analysis performs the essential function of converting mass data into useful information. Such analysed financial information serves many and varied purposes as described below:

- 1. To Know the Profitability : According to Robert Anthony, “the overall objectives of a business are to earn a satisfactory return on the funds invested in it, consistent with maintaining a sound financial position.” Profitability is a measure of a company’s efficiency and success. Potential investors examine the financial accounts to determine the profitability and earning capacity of the commercial enterprise before deciding whether or not to invest in it.

- 2. To Know the Financial Strength : The objective of financial analysis is to investigate the future potential of the concern. For this, analysis helps in providing answers to the following questions :

- a. Funds required for modernisation and expansion of the business will be available from internal resources or not ?

- b. How much funds can be raised from external resources on the basis of goodwill ?

- 3. To Know the Solvency : Solvency determines the ability of a business concern to meet its short-term debts such as creditors, bills payable and bank overdraft, etc. and long-term debts such as debentures, bank loan, etc. It can be ascertained from the analysis of financial statements.

- 4. To Know the Managerial Capacity : The performance and efficiency of a company enterprise’s management can be easily determined by studying its financial accounts. Profitability is not merely a measure of a company’s managerial efficiency. There are also different approaches to determine management’s operational efficiency. Financial analysis determines whether a company’s resources are being used in the most effective and efficient manner.

- 5. To Know the Trend of the Business : Accounting data about sales, costs, earnings, and so on for two or more years of a company show the direction in which the company is moving. If sales continue to rise as profit margins rise, it reflects a concern’s growth pattern. This type of study can assist determine whether a company is progressive or not.

- 6. To Know the Capability of Payment of Dividend and Interest : The goal of the research is to determine whether the company has the ability to pay the dividend and interest on time. How much profit is there in relation to interest? The analysis reveals how far the company’s profit can fall without jeopardizing its capacity to satisfy dividend and interest obligations.

- 7. To Make Comparative Study with Other Similar Concerns : The goal of financial analysis is to conduct a comparative assessment of the operational efficiency of similar businesses operating in the same trade. Such a comparison allows management to understand their company’s position in terms of sales, expenses, profit, and working capital, among other things, in comparison to other companies.

- 8. To Know the Useful Information : The purpose of financial analysis is to get the information about the weak spots of the business. The information is also useful to management, creditors, shareholders, etc. So, the management can take remedial measures at proper time.

On the basis of above, it can be said that the object of financial analysis is to know about :

(a) profitability (b) solvency and (c) financial potential of the business.

Q11. What do you understand by capital structure? What are the major determinants of it?

Ans. The capital structure of a company refers to how it decides to finance its assets and investments through a combination of equity, debt, and internal money. It is in a company’s best interests to discover the optimal debt-to-equity ratio in order to avoid the danger of insolvency, continue to be successful, and eventually remain or become profitable. A company’s capital structure is determined by a variety of elements, including leverage or trading on equity, the company’s growth, the form and scale of the business, the idea of keeping control, capital structure flexibility, investor needs, the cost of flotation of new instruments, and so on.

Determinants of Capital Structures: Following are the determinants of capital structure :

- (a) Financial Leverage or Trading on Equity: The use of long term fixed interest bearing debt and preference share capital along with equity share capital is called financial leverage. The main determinant of capital structure is cost of debt because (i) the cost of debt is usually lower than the cost of preference share capital and (ii) the interest paid on debt is a deductible charge from profits for calculating the taxable income while dividend on preference shares is not. Because of its effect on the earnings per share, financial leverage is one of the important considerations in planning the capital structure of a company. The companies with high level of the Earnings Before Interest and Taxes (EBIT) can make profitable use of the high degree of leverage to increase return on the shareholders’ equity, One common method of examining the impact of leverage is to analyse the relationship between Earnings Per Share (EPS) at various possible levels of EBIT under alternative methods of financing. The EBIT-EPS analysis is one important tool in the hands of the financial manager to get an insight into the firm’s capital structure management. He can consider the possible fluctuations in EBIT and examine their impact on EPS under different financing plans. The earnings per share also increase with the use of preference share capital but to the act fact that interest is allowed to be deducted while computing tax, the leverage impact of debt is much more.

- (b) Growth and Stability of Sales: The growth and stability of a company’s revenues have a significant impact on its capital structure. If a company’s sales are predicted to remain relatively consistent, it can take on more debt. Sales stability assures that the company will be able to satisfy its fixed commitments of interest payments and debt repayments. Similarly, the rate of sales growth influences the capital structure selection.

- (c) Cost of Capital: Every dollar invested in a company comes at a cost. The minimum return expected by its suppliers is referred to as the cost of capital. The projected return is determined by the level of risk taken by investors. Shareholders bear a higher level of risk than debt investors. The capital structure should be designed to have the lowest possible cost of capital. Measuring the cost of multiple sources of cash is a complicated problem that requires its own approach. It goes without saying that lowering the cost of capital is beneficial. As a result, if all else remains constant, cheaper suppliers should be favoured.

- (d) Risk: There are two types of risk that are to be considered while planning the capital structure of a firm viz (i) business risk and (ii) financial risk. Business risk refers to the variability to earnings before interest and taxes. Business risk can be internal as well as external. Internal risk is caused due to improper products mix non availability of raw materials, incompetence to face competition, absence of strategic management, etc. internal risk is associated with efficiency with which a firm conducts it operations within the broader environment thrust upon it. External business risk arises due to change in operating conditions caused by conditions thrust upon the firm which are beyond its control, e.g. business cycle.

- (e) Flexibility: The ability of a firm to adapt its capital structure to changing situations is referred to as flexibility. A firm’s capital structure is flexible if it can easily change its capitalization or sources of cash. When necessary, the organisation should be able to raise capital quickly and affordably to finance lucrative investments. The corporation should also be able to redeem its preferred capital or debt if future conditions warrant it. The company’s financial plan should be adaptable enough to allow for changes in the capital structure’s composition. It should maintain the ability to switch from one type of financing to another in order to save money.

- (f) Requirement of Investors: Another aspect that influences a firm’s capital structure is the needs of its investors. When using debt financing, it is vital to accommodate the needs of both institutional and individual investors. There are three types of investors: bold investors, cautious investors, and less cautious investors.

- (g) Inflation: Another factor to consider in the financing decision is inflation. By using debt financing during periods of high inflation, we will repay the debt with dollars that are worth less. As expectations of inflation increase, the rate of borrowing will increase since creditors must be compensated for a loss in value. Since, inflation is a major driving force behind interest rates, the financing decision should be cognisant of inflationary trends.

- (h) Legal Considerations: At the time of evaluation of different proposed capital structure, the financial manager should also take into account the legal and regulatory framework. For example, in case of the’ redemption period of debenture is more than 18 months, then credit rating is required as per SEBI guidelines. Moreover, approval from SEBI is required for raising funds from capital market whereas no such approval is required-if the firm avails loans from financial institutions. All these and other regulatory provisions must be taken into account at the time of deciding and selecting a capital structure for the firm.

Q12. ‘Efficient’ cash management will aim at maximising the cash inflows and slowing cash outflows’. Discuss this statement.

Ans. Cash management involves the following three basic problems:

1. Controlling Level of Cash : One of the basic obiectives of cash management is to minimise the level of cash balances with the firm, This obiective is sought to be achieved by means of the following :

- a. Preparing Cash Budget : The cash budget is the most significant tool for planning and regulating cash usage. It is a prediction of the firm’s future cash receipts and cash payments over various time intervals. It shows the financial management the date and quantity of expected cash receipts and payments throughout time. Based on this information, the finance manager may forecast the firm’s future cash needs, plan for financing these needs, and exercise control over the company’s cash and liquidity.

- b. Providing for Unpredictable Discrepancies : The cash budget displays the differences between cash revenues and payments based on routine business activity. It does not account for certain unforeseeable differences in cash inflows and outflows caused by unforeseen circumstances such as strikes, lock-outs, recessions, abrupt increases in raw material prices, natural calamities, and so on. A reasonable cash balance must consequently be maintained to face such unforeseeable eventualities. Provision for contingencies is made based on past experiences and some future intuitions.

- c. Consideration of Short Costs : The term ‘Short Costs’ refers to the cost incurred as a consequences of shortage of cash. Such cost may take any of the following forms :

- i. The failure of the firm to discharge its obligations in time may result in legal action by the creditors against the firm. This will cost in terms of fall in the firms goodwill, in addition to the financial costs of defending the suit.

- ii. The firm may have to borrow funds at high rates of interest and may also be required to pay penalties to banks for not meeting the obligation in time.

- iii. There may also be the loss of cash discount, besides losing opportunity of purchases at lower prices.

2. Controlling Inflows of Cash: In order to prevent fraudulent diversion of cash receipts and speeding up collections of cash, an adequate control on cash inflow is necessary. A properly installed internal check system can, to a great extent, minimise the possibility of fraudulent diversion of cash.

Speedier collection of cash can be made possible by adoption of the following two techniques, which have been found quite useful and effective in the USA.

- a. Concentration Banking System : It is a system of decentralizing collections of account receivable. According to this system company’s regional branch offices are authorised to Collect the payments from the customers and deposit in the local bank accounts. instructions are given to the regional or local collection centres to transfer the funds over a certain limit to the company’s head office bank daily either telegraphically or by telex. Regional offices on the collection centres maintain an account of cost of remittances paid by them. This system facilitates fast movement of funds. On the basis of the daily report received from the head office bank about the collected funds, the treasurer can use them for disbursement as per requirements. This system is good in case of large firm having their Spread over a large area. The system of concentration banking, therefore, helps in quicker collections of cash.

- b. Lock Box System : This system is more popular in the USA and is a further step in speeding up collection of cash. Under this system the company hires a post office box and instruct its customers to mail their remittances to the box. The company’s local bank is authorised to pick the remittances directly from the local box, The bank picks up the mail several times a day and deposits the cheques in the company’s account. Standing instructions are also given to the local banks to transfer the collected funds to the head office bank when they exceed a certain limit. This system speeds up collection of cheques and the firm comes to know about the dishonored cheques and weak credit situation very soon. It also reduces the chances of fraud in the cash collection pro cess and controls the cash inflows better. In order to avoid the unnecessary pockets of idle funds, the company should maintain minimum number of bank accounts.

3. Controlling Outflows of Cash : An effective control over cash outflow is equally important for conserving cash and reducing financial requirements. Control over cash outflows signifies slow disbursements. A combination of fast collections and slow disbursements will, obviously, result in maximum availability of cash funds. In order to control the outflows of cash efficiently, a firm should keep in view the following considerations :

- a. Centralised system for cash payments should be followed as compared to decentralised system. All payments should be made from a single control account, i.e. from the central office of the company. However, local expenses may be paid by the local office of the company. This will result in delay in presenting cheques for payment by creditors who are away from the place of control account.

- b. Payment should be made on the due dates neither before nor after. The company should neither lose cash discount nor its prestige on account of delayed payments. The company should, therefore, made payments within the terms offered by the suppliers.

- c. ‘Playing Float’ techniques should be used by the company for maximising the availability of funds. The term float’ means the account tied up in cheques which have been issued by the company but have not yet been presented for payment by the creditors. As a result of a time-lag between issue of a cheque and its actual presentation, the actual bank balance of a firm may be more than the balance shown by its books. This difference is called ‘payment in float’. The longer the lost period’ the greater would be the benefit to the firm, If the financial manager can accurately estimate the time-lag between issue of cheques and actual presentation for during the intermittent period. In the meanwhile, necessary cash may be arranged and deposited in the bank before the presentation of cheques for payment. However, playing float is a risky game and should be played very cautiously. In case, the cheques issued by the company are dishonoured, the goodwill of the firm will be at stake and it may have seriously adverse consequences for the firm.

Q13. Describe the principal ratios, which you consider significant to judge the (i) Profitability, and (ii) Solvency of a concern.

Ans. (i) Profitability Ratio: A company exists to make money. Profits are required not only for survival, but also for expansion and diversity. Profits can be used to assess the effectiveness of management and personnel. It can also be used to provide security to creditors. The profitability position of the business conveys numerous meanings. It demonstrates the efficiency of management, the worth of investment, the organisation’s tax paying capacity, and its overall effectiveness. Profitability is also significant in determining the influence of various decisions on corporate efficiency, such as price cuts, increased selling prices, and changes in tax structure.

For the purpose of determining profitability status of a business, varíous ratios are used. These ratios are :

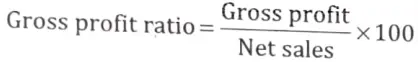

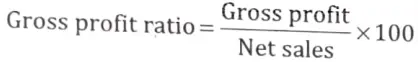

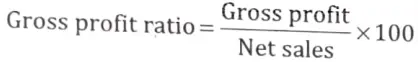

(a) Gross Profit Ratio: This ratio is also known as This ‘Gross Margin Ratio’ or “Trading Margin Ratio. ratio is generally expressed in percentage and shows the relationship between the net sales and gross profit.

Gross profit ratio is helpful for determining the ability of the business to meet its operating expenses. It also shows shareholder’s share after meeting operating expenses. The ratio is calculated as below:

Where, Gross profit = Net sales – Cost of goods sold and

Cost of goods sold = Opening stock + Purchases (Net) + Direct expenses – Closing stock and

Net sales = Total sales – Sales returns

Interpretation: The gross profit ratio displays the average profit margin on products sold. The ratio depicts the overall profitability of the company. A high ratio suggests that the company may create a high margin on the things it sells. This ratio can be used to perform a temporal analysis. It can also be used to compare the performance of different companies. To keep its financial position and demand stable, the company should maintain optimum profitability ratios.

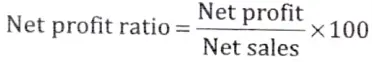

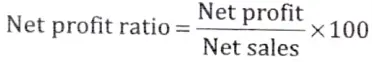

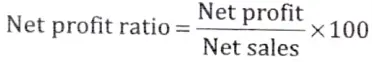

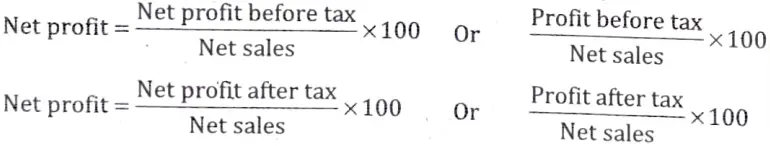

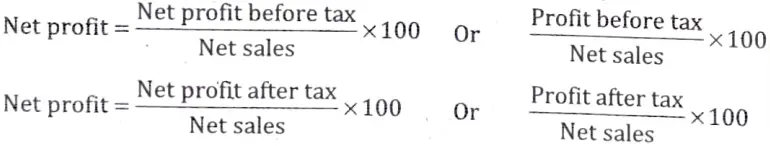

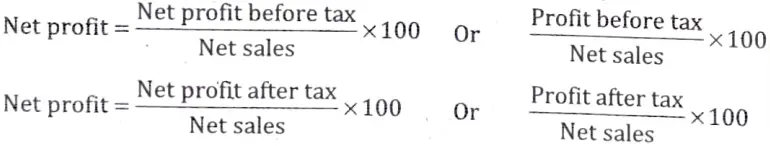

(b) Net Profit Ratio: This ratio is also known as ‘the net profit to sales ratio’ or ‘net profit margin’ and expresses the rate of the net profit for every unit of revenue. The ratio is calculated by dividing net profit by net sales for the concerned period. It can be expressed as below :

Two different approaches may be used for this purpose as net profit may be defined as net profit before tax or net profit after tax :

Interpretation: Net profit ratio measures the overall profitability of the business. A temporal analysis may be done to see the trend in profitability of the firm, where one year’s net profit ratio is compared with another year’s net profit ratio. This ratio should be used in conjunction with other ratio such as turnover ratios to get overall picture of the business concern and to see how efficiently the business assets are being used.

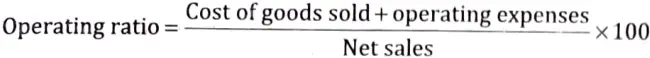

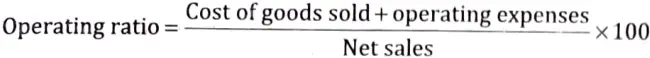

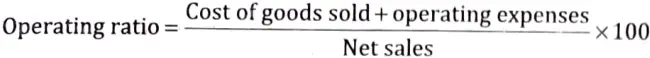

(c) Operating Ratio: This ratio measures the relation between sales and the expenses incurred for making such sales. Following is the formula used for calculating operating ratio:

Operating expenses are charged against earnings which include administrative expenses (like salary, tax, rent, light bills, legal charges) and selling and distribution expenses (like packing, warehousing, discount received, commission on sales etc.). This ratio ignores non-operating income and expenses, eg. financial expenses and incomes such as interest, provision for taxation, etc.

Interpretation: This ratio shows the cost structure of a firm. Higher operating ratio indicates that the firm has less margin for meeting its non-operating expenses and thus is in unhealthy financial condition. Efficient firms show low operating ratios.

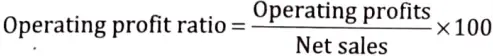

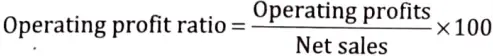

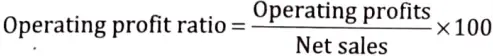

(a) Operating Profit Ratio: This ratio is a type of net profit ratio and determines the relationship between operating profits and sales. The ratio is calculated using following formula:

Operating profit is the difference between operating revenue and operating expenses such as cost of goods sold, selling and distribution expenses and-office and administration expenses. It ignores non-operating expenses and incomes. Financial expenses such as interest, taxation, dividend and losses due to fire are also excluded. Following equations are used for calculating operating profits:

Operating profit = Sales – (Cost of goods sold + Administrative office expenses + Selling and distribution expenses)

Or

Operating net profit = Net profit + Non-operating expenses – Non-operating incomes

Or

Operating net profit = Gross profit + Operating incomes – Operating expenses

Interpretation: Operating profit ratio is more appropriate than the net profit ratio for the purpose of determining operating efficiency. Net profit ratio may give misleading results as it includes non-operating expenses and incomes as well. High operating profit ratio indicates that the business is being managed efficiently.

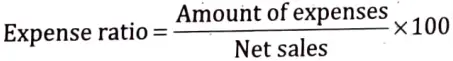

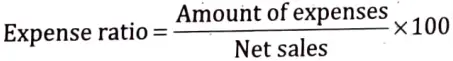

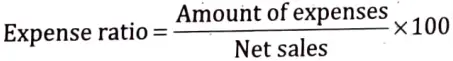

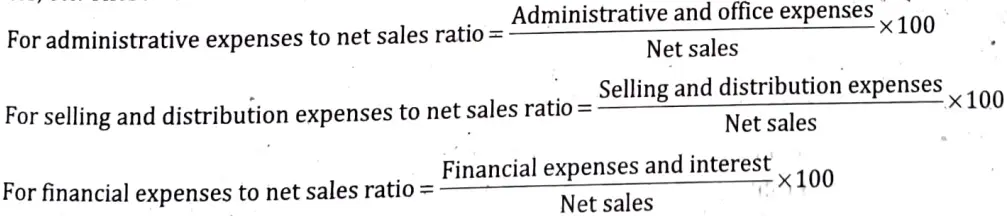

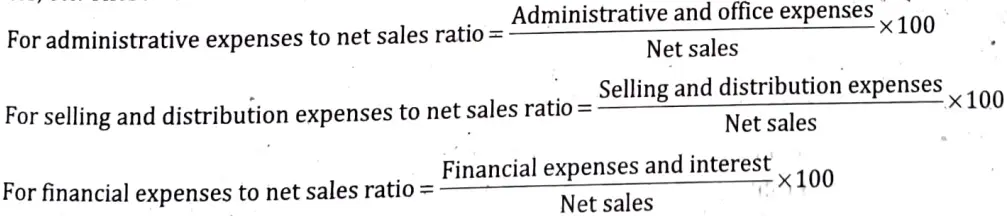

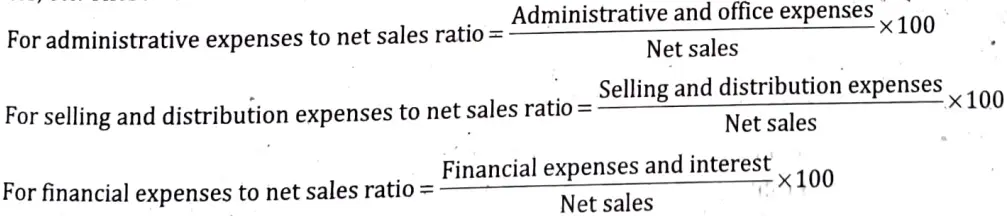

(e) Expenses Ratio: This ratio shows the relationship between several expenses and net sales. This ratio depicts the increase and decrease of expense. Lower expense ratio show efficiency in operations.

Following formula is used to calculate expense ratio:

Different expense heads can be used for this purpose. Various ratios included under this category are administrative expenses to net sales, ratio of selling and distribution expenses to sales, financial expenses to sales, etc. These ratios can be calculated as below:

Interpretation: The expense ratio can be used as a control measure as well. A steady or declining expense ratio shows that the firm is endeavouring to control its expenses.

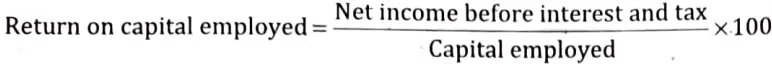

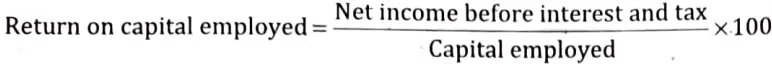

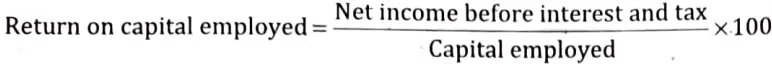

(f) Return on Capital Employed/Return on Investment: Return on capital employed is calculated by using net income and total capital employed. The ratio is useful for assessing the firm’s ability to generate sufficient return on its capital invested. It is expressed asa percentage. Following is the formula used for the purpose of calculating this ratio:

The term capital employed may be interpreted in different ways as follows:

Gross Capital Employed: This term includes fixed as well as current assets. Fixed assets are calculated after deducting depreciation.

Gross capital employed = Fixed assets + Current assets

Net Capital Employed: It refers to the sum of working capital and fixed assets. It may also be defined as total assets minus current liabilities.

Interpretation: This ratio is used to measure the efficiency of a business is generating return on its investment. The higher the ratio, the better it is, as it shows robust overall profitability.

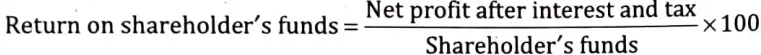

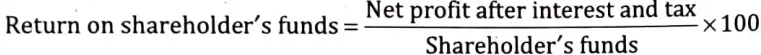

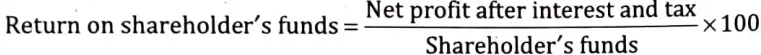

(g) Return on Equity or Return on Equity Shareholders’ Funds: This ratio is calculated to know the firm’s profitability from the perspective of shareholders.

Following is the formula used for the purpose of calculating this ratio:

Here,

Shareholders’ funds = Equity share capital + Preference share capital + Share premium + Revenue reserve + Capital reserve + Retained earnings Accumulated losses

Or

Shareholders’ funds = Fixed assets + Current assets – Current and long-term liabilities

Interpretation: This ratio is helpful for making inter-firm comparison. It can also be used for comparing performance over a period of time. This ratio helps in determining whether a firm is performing well in comparison to its peers. It also determines whether the shareholders are earning adequate return on their investment.

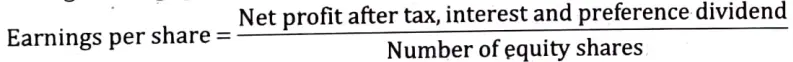

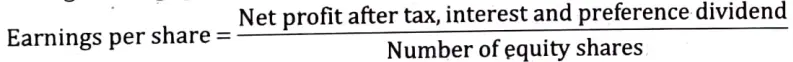

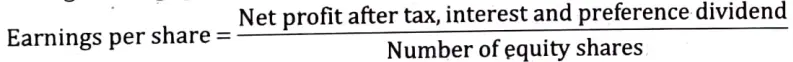

(h) Earnings Per Share (EPS): This ratio is calculated to find profitability per share. The formula for calculating earnings per share are as follows:

Interpretation: Earnings per share is useful to determine the market price of equity shares. It also shows the business’s ability to pay dividends to its investors.

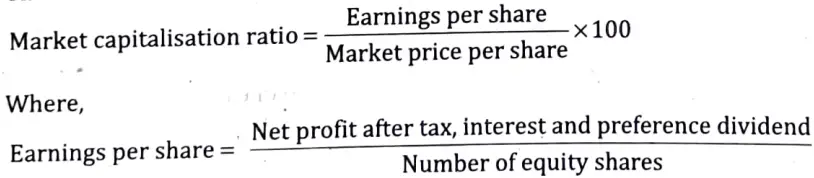

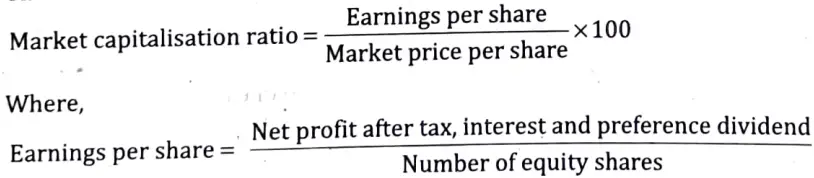

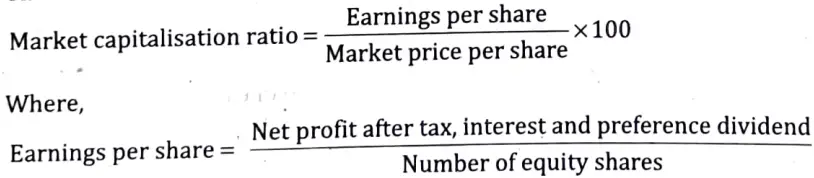

(i) Market Capitalisation Ratio: This ratio establishes the relationship between earnings per share and market price. This is also referred to as ‘mid cap’.

The ratio is calculated as below:

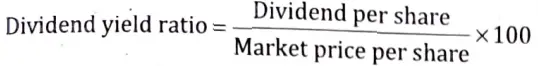

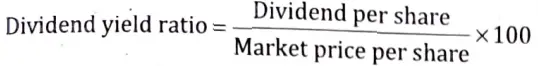

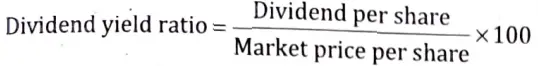

When the market price is received with dividend, it is referred to as dividend yield ratio. Dividend yield ratio is calculated by comparing market price of the share with the dividend paid. The formula for this purpose is calculated as below:

Where,

Dividend per share = Unit per share x % of dividend

Interpretation: If the company share price is high, the dividend payout is low and vice versa.

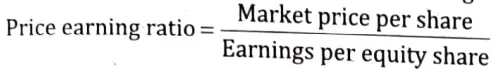

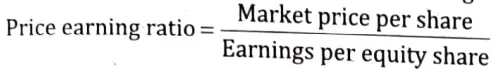

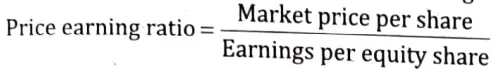

(j) Price Earning Ratio or P/E Ratio (Earning Yield Ratio): This ratio establishes the relationship between market price of the share and its earnings. Following formula is used for this purpose:

Interpretation: This ratio is very widely used. It helps the investors in deciding whether the shares are fairly priced or not. High P/E ratio shows that the firm will take longer to recover its market price. This ratio is affected by various market factors. It can also be used for predicting future market price of the share.

(ii) Solvency Ratios: These ratios offer an insight into financial performance of a business. These ratios also deal with long-term solvency position of the business as these help to know whether the business would be able to honour its interest payment and principle payment commitments.

Debt-equity ratio, interest coverage ratio, proprietary ratio and capital gearing ratio are included in this category.

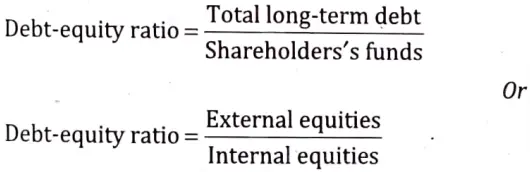

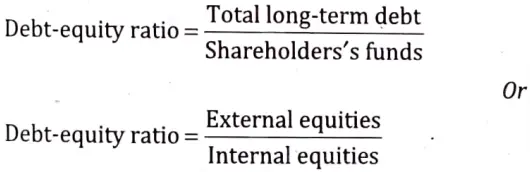

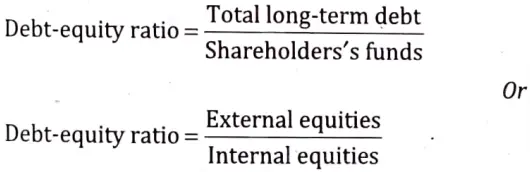

(a) Debt-equity Ratio: This ratio is often referred to as the “External-Internal Equity Ratio.” This ratio is used to assess the effectiveness of a company’s long-term financial strategy. It also contrasts the stakes carried by insiders and outsiders. This ratio illustrates the link between equity and loan finance.

The ratio is calculated as below:

where,

Total long-term debt = Debentures + Term loans + Loan on mortgage + Longs from financial institutions + Other long-term loans + Redeemable preference share capital

Shareholders’ funds = Equity share capital + Irredeemable preference share capital + Capital reserves + Retained earnings + Any earmarked surplus like provision for contingencies, etc. – Fictitious assets

Interpretation: High Debt-equity shows that the business is making more use of debt funds and thus is aggressive in its financing decisions.

High debt financing helps the business in generating higher magnitude of earnings than it may have without recourse to debt funding. This benefits shareholders if the business increases its earnings by more than its interest commitments.

(b) Proprietary Ratio: This ratio establishes the relationship between proprietors’ funds and the total assets of the business. The main purpose of this ratio is to determine the sources for financing the assets.

Following are the two main components of this ratio:

Proprietors’ funds (excluding fictitious assets like preliminary expenses) and

Total assets.

This ratio is computed by dividing the proprietors’ funds by total assets in the following way:

Interpretation: A higher proprietary ratio indicates that assets are mostly funded by shareholder funds, which is regarded positive for the company’s long-term solvency. The ratio also indicates the extent to which the company’s assets can be lost without affecting the interests of its creditors.

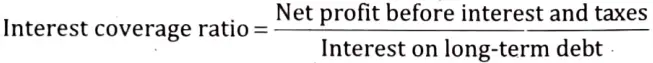

(c) Interest Coverage Ratio/Debt-Service Ratio: This ratio establishes a relationship between interest on long-term debt and net profits before interest and taxes. It is useful for determining the capability of a business in meeting its fixed interest obligations for its long-term loans.

The ratio is expressed as ‘n’ number of times and is calculated using the following formula:

Interpretation: A low interest coverage ratio indicates that the corporation is heavily in debt. It also signals a greater likelihood of default or insolvency. A coverage ratio of 1.5 or less shows that the corporation is having difficulty paying its interest payment obligations. The ratio less than one indicates that the company’s interest liabilities exceed its EBIT or earnings, and hence the company may have difficulty meeting its interest commitments.

A high ratio indicates that the company is financially sound. It demonstrates that the corporation generates operating income that exceeds its interest obligations. A highly high ratio, on the other hand, indicates that the corporation is not fully utilising leverage.

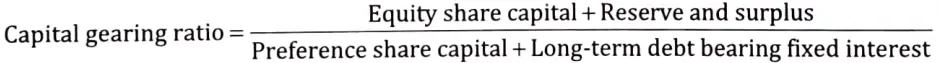

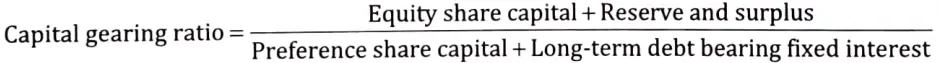

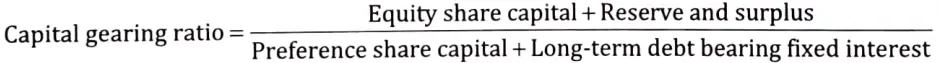

(d) Capital Gearing Ratio: This ratio explains the relationship betwèen equity share capital and fixed interest bearing securities including preference shares. For the purpose of this ratio, equity share capital includes reserves.

The formula to calculate this ratio is as follows:

Note: The long-term instruments that have fixed interest bearing are debt/debentures and long-term loan. Interpretation: A high ratio suggests that the company is highly geared or leveraged. Similarly, a low ratio indicates that the firm has low leverage. The preference share capital and other fixed interest bearing loans of a highly geared firm exceed the equity share capital and reserves. For a low-geared firm, the situation is inverted. It is a significant ratio. In order to preserve profitability and long-term solvency, the corporation should strive for proper gearing. A high gearing ratio indicates a large fixed interest commitment, which is favourable for future business contingencies.